For "Summary Saturday": News, some new, some old:

U.S. National Debt Clock October 2013

"An Overview of the United States National Debt

"An Overview of the United States National Debt

The Current Outstanding Public Debt of the United States is:

$16,747,468,275,799.27

Last Updated: Saturday, October 5th, 2013

Every man, woman and child in the United States currently owes$55,122 for their share of the U.S. public debt

Public Debt: $11,937,127,964,522.94

Intragovernmental Holdings: $4,810,340,311,276.33

Total U.S. National Debt: $16,747,468,275,799.27

Question: Who owns the public debt?

Answer: Mutual funds, pension funds, foreign governments, foreign investors, American investors, etc.

Which Foreign governments own the most U.S. debt?

Answer: Here is the Top 10 (as of May/2013)

1. China, Mainland, $1315.9 billion dollars

2. Japan, $1111.0 billion dollars

3. Oil Exporters*, $266.3 billion dollars

4. Brazil, $255.5 billion dollars

5. Carib Bnkng Ctrs**, $253.2 billion dollars

6. All Other, $218.9 billion dollars

7. Taiwan, $189.4 billion dollars

8. Switzerland, $187.0 billion dollars

9. Belgium, $171.0 billion dollars

10. United Kingdom, $155.2 billion dollars

*Includes oil exporting countries such as Saudi Arabia and Iran

**includes countries such as Bermuda and the Cayman Islands

Of the $5.1 trillion dollars of US debt that is owned by foreign governments, China and Japan own nearly half, as evidenced by this chart:

Growth of US Debt Over Past 50 Years

Current: $16,747,468,275,799.27

2010: $13,178,317,356,215.73

2004: $7,379,052,696,330.32

1999: $5,656,270,901,615.43

1994: $4,692,749,910,013.32

1989: $2,857,430,960,187.32

1984: $1,572,266,000,000.00

1979: $826,519,000,000.00

1974: $475,059,815,731.55

1969: $353,720,253,841.41

1964: $311,712,899,257.30

1959: $284,705,907,078.22

Commonly Asked Questions:

How much Money does the United States Owe China?

A: $1.32 Trillion (May/2013)

How much Money does the United States Owe Japan?

A: $1.11 Trillion (May/2013)

How much Money does the United States Owe Russia?

A: $150.9 Billion (May/2013)

How much Money does the United States Owe the United Kingdom?

A: $155.2 Billion (May/2013)

How much Money does the United States Owe Germany?

A: $62.7 Billion (May/2013)

How much Money does the United States Owe Canada?

A: $59.7 Billion (May/2013)

From: http://www.davemanuel.com/us-national-debt-clock.php

_______

Kitchen Table Economics

"There are times when households reach the end of their financial resources and have to declare bankruptcy. Their income cannot meet their debts. Has America come to such a defining moment?

Break old habits and begin to get control of your personal finances.

Source: Photos.com

One of my uncles was a farmer who hit on hard times and had to declare bankruptcy. I well remember the night he and his wife came to my parents' home, sat down at our kitchen table and spread out their financial papers. They had some paperwork to accomplish and file with the court before they left town. Their eldest son had found factory work out of state, and they were traveling north to join him, in hopes that they too would find hourly work to enable them to get a fresh start in life.

My uncle was a small farmer, and too many bad years finally caught up with him. I remember the hushed talk that night in our home as he and my parents went over their plight and what that would mean for the family. Sound financial management is vital to the family unit—and to society at large. It makes the difference between stability and chaos—for both households and entire nations.

The United States is bankrupt

The United States of America is facing a defining moment in its history. On April 18, 2011, as CNNMoney reports, "S&P [Standard & Poor's], one of the three main agencies that rate the ability of companies and sovereign nations to repay their debts, lowered its outlook for America's long-term credit rating to 'negative' from 'stable.' The change means that there is a one-in-three chance that S&P could downgrade the nation's 'AAA' credit rating within two years. That would make it harder for the U.S. government to borrow money to fund its activities" (April 19, 2011).

The sad reality is that the country is fiscally bankrupt, and unless it makes some fundamental changes it will decline as a great power. Other countries will not only take America's place in the world but will also dictate much of its future.

Anyone who honestly looks at the amount of debt we owe and the obligations coming due in the future can see that we don't have the money in hand and currently owe more than we can pay. President Barack Obama's proposed budget for the next fiscal year nearly doubles the current debt position.

No one with an ounce of fiscal sanity can stand by and watch this train wreck about to happen without asking serious questions about the future of the country. Entitlement programs such as Social Security, Medicare and Medicaid are unsustainable. Promises made to a generation of Americans cannot be met without the United States government going deeper in debt to other nations who are willing to finance our profligate spending patterns.

China, Japan and Saudi Arabia have been willing to buy our bonds and treasury bills, in effect loaning us money to finance what we cannot afford. They hold our future in their hands. Like any bank or lending institution, they can call that debt by demanding payment. If you cannot pay you have to return the goods or declare insolvency. For an individual this is bankruptcy. For a nation it could mean economic servitude.

Grasping the scope of the problem

When we speak of trillions of dollars of national debt it's hard to really picture what that means. The Wall Street Journal recently carried a story with an illustration that brings this subject home to the kitchen table. Freshman Republican Congressman Mick Mul-vaney of South Carolina explained to a group of his constituents just how serious America's debt problems are. "It's much, much worse than I had expected," he stated.

"Picture, he suggested, a family of four with an income of $46,000, annual costs of $78,000, and a credit-card debt of $281,000. That drew a gasp from the audience of mostly older voters. The figures are roughly proportionate to federal government revenue, annual outlays and the accumulated national debt, he said" (April 1, 2011).

I think we all know what that would mean if you were sitting around your kitchen table. The answer would be to file for bankruptcy, sell your assets to pay what you could to creditors and hope for a new start.

When we hear figures of billions and trillions of dollars of national debt we instantly glaze over. No one really understands how much money a trillion dollars is. Mention that America's debt could reach $16 trillion and we tune out. But bring it down to what that means for a family of four and we begin to get the picture.

The United States has been able to avoid the consequences of massive debt for a number of reasons. Macroeconomics works a bit differently than microeconomics, the level where the average person functions. Because of its size, power and scale of population, a large nation can go a long time without paying back outstanding debt to the rest of the world. America has been running budget deficits for decades, and because other nations have reason to accept and enable this behavior the situation continues.

Enabling factors

One reason is that America is the world's largest consumer nation. China's rise in recent decades has been tied to America's demand for cheap labor to produce things it wanted. Japan's earlier rise was based on this to some degree as well. It has been to these nations' advantage to see America remain in this position. If financing U.S. debt is perceived as good for business, then that's what is done.

Arab nations like Saudi Arabia produce oil that fuels America's, and much of the world's economy. Petro dollars are good for the region and its ruling governments.

Factor in the military might of America. It protected Europe from the Soviets during the Cold War, sheltered Japan from encroachment by other Asian powers and kept the sea lanes of global commerce free and open for the world economy. The desire to maintain America in its protective role is part of why key nations have been willing partners in its descent into debtor status.

Could this come to change?

It could through any number of ways. Imagine one scenario: To finance America's debt the U.S. Federal Reserve prints more and more dollars. Since many of the basic commodities like food and fuel are denominated in dollars, this flooding of markets creates a rise in costs, called inflation. More dollars chasing fewer goods, or goods in greater demand, create a problem. (See "A Note About Inflation".)

When a person in Damascus or Cairo can't afford the rise in food costs and has to go without, it causes unrest. This leads to food riots and the potential for other instability. A commentator recently wrote, "When the Fed sneezes money, the weak economies of the world, and the poor masses who are highly vulnerable to price rises in the necessities of life, catch pneumonia."

The Middle East is already seeing massive instability. Unrest is leading to change in governments, some of which may not be as friendly to American interests in the region. They will not be able to withstand domestic upheaval. If such unrest is linked to American fiscal policy, you have another reason for some to turn from old alliances to pursue their own self-interest.

Back to the kitchen table

Prices are rising in America as well. Food prices are going up, and gasoline is over $3 per gallon. While this is catching up with the rest of the world, it can't help but have an impact on the American consumer. When jobs and incomes do not keep up with inflation, cuts in lifestyle will be dictated. Those prepared can manage. Those who aren't will face constricting challenges.

Lawmakers in the U.S. Congress have been making proposals to begin to deal with the budget deficits. Proposals introduced in early April target the nation's health care and social entitlement programs. Changes to the tax structure are also on the table. If such changes are enacted, and if other world factors remain stable, there is some hope that America could pull out of the decline and return to fiscal stability.

Which brings me back to the kitchen table.

My uncle's bankruptcy taught him a big lesson. He moved out of a farming career to which he was not suited. The day of the small farmer was passing, and he needed to move on to other work. He found it in a factory and went on to make a living wage and another life. He later retired and moved back to our home area and died at a good age. He never again filed for bankruptcy.

You and I live in a highly challenging period, with the opportunity to learn deep and enduring lessons. Massive, uncontrollable debt is not good. As we watch large nations struggle with crippling debt loads, we are offered the chance to change our own immediate behavior regarding money. It's as if God is giving you and me the chance to prioritize our values and bring our spending habits in line with our income—to live a realistic life with the income we have.

Perhaps this is the one opportunity you will have to break old habits and begin to get control of your personal finances. If you choose to do so, we can help. We have a free booklet, Managing Your Personal Finances, that presents a biblical foundation for financial management. It offers practical advice along with budgeting tools to help you turn around this part of your life. You can read or download it at our website or request a copy from the address on the inside cover of this magazine.

Sit down at your kitchen table. Take a completely honest look at your income and expenses. Do something today's lawmakers find difficult to do, and get control of your financial life." From: http://www.ucg.org/finances/kitchen-table-economics/ Article by Darris McNeely

________

30th.Sept. 2013: http://www.forbes.com/sites/afontevecchia/2013/09/30/shutdown-and-debt-ceiling-debate-prove-u-s-doesnt-deserve-aaa-credit-rating-sp/

1st. Oct. 3013: http://www.forbes.com/sites/deanpopplewell/2013/10/01/u-s-government-shutdown-sinks-dollar/

________________

A Note About Inflation

It should be realized that inflating the money supply is actually massive fraud and theft.

Source: Photos.com

"By printing more dollars for the government's and central bankers' own purposes, the value of every dollar held by others is made less. In essence, the value of the dollars in your wallet is stolen by the government and Federal Reserve to use as they see fit. Of course, this means that dollars and other debt instruments held by foreign countries are also worth less—and if inflation is unabated, these nations will eventually tire of having so much stolen from them and will transfer their wealth somewhere more secure. (Of course, these other nations do the same with their own currencies.)" From: http://www.ucg.org/finances/note-about-inflation/ Article by Tom Robinson

_______

What does a trillion $ look like?

"What happens when the Federal reserve decides to inject ANOTHER trillion to buy treasury bonds and mortgage securities. In another words they simply decide to print another trillion dollars. So I thought you would really enjoy this graphic illustration to help you put that number into perspective.

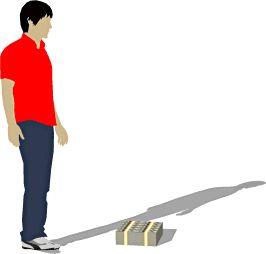

$100

Start with a simple $100 bill.

$10,000

A packet of $100 bills worth $10,000 is less than 1/2 inch thick.

$1,000,000

This little pile of cash can easily fit into any backpack and weighs just about 22 lbs.

$100,000,000

$100 million fits neatly on any standard pallet, weighing in at a little over one ton.

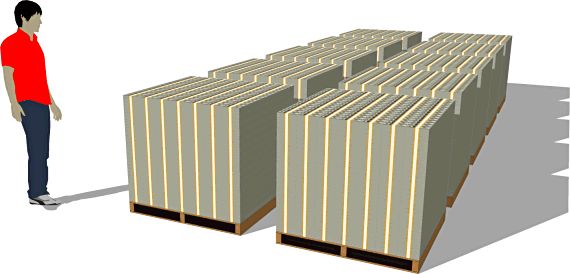

$1,000,000,000

$1 billion is ten pallets worth of cold, hard cash.

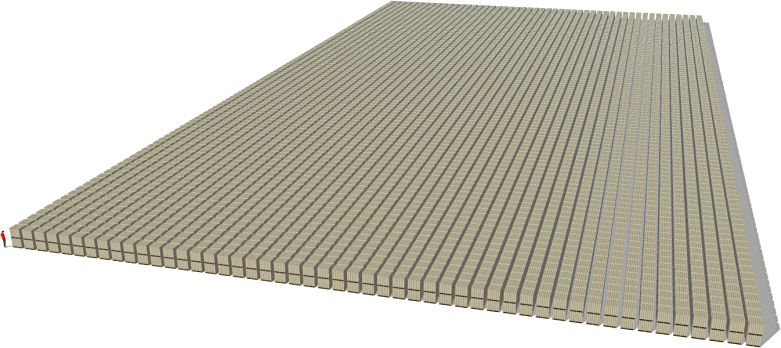

$1,000,000,000,000

Finally, here’s one trillion dollars:  "

"

Now imagine SIXTEEN TRILLION!"

_______

On This Day:

American circumnavigates the globe on foot, Oct 5, 1974:

"American David Kunst completes the first round-the-world journey on foot, taking four years and 21 pairs of shoes to complete the 14,500-mile journey across the land masses of four continents. He left his hometown of Waseca, Minnesota, on June 20, 1970. Near the end of his journey in 1974 he explained the reasons for his epic trek: "I was tired of Waseca, tired of my job, tired of a lot of little people who don't want to think, and tired of my wife." During the long journey, he took on sponsors and helped raise money for UNICEF.

He was accompanied by his brother, John, but in 1972 John Kunst was shot to death by bandits in Afghanistan and David was wounded. After returning to Minnesota to recuperate, Kunsk traveled back to Afghanistan and continued his global journey with another brother, Peter. Peter had to drop out later for health reasons, and David Kunst completed his trek alone, returning to Waseca on October 5, 1974."

_______

Apple founder Steve Jobs dies, Oct 5, 2011:

"On this day in 2011, Steve Jobs, the visionary co-founder of Apple Inc., which revolutionized the computer, music and mobile communications industries with such devices as the Macintosh, iPod, iPhone and iPad, dies at age 56 of complications from pancreatic cancer.

Despite a series of medical issues, including surgery in 2004 to remove a pancreatic tumor and a 2009 liver transplant, Jobs continued to lead Apple until August 24, 2011, when he stepped down as the company’s chief executive. Six weeks later, he passed away at his Palo Alto, California, home. At the time of his death, Jobs, a father of four, had a net worth estimated at more than $7 billion. According to biographer Walter Isaacson, Jobs “was the greatest business executive of our era, the one most certain to be remembered a century from now. History will place him in the pantheon right next to Thomas Edison and Henry Ford.”"

_______

Yesterday:

As the screen porch floor paint was dry, Ray and I scurried around to get all the screen porch furniture out of my living room and back where it belongs.

My insurance company has started sending a nurse out to each patient annually, to assess them, I guess. Yesterday was my turn for her visit.

She was over 2 hours late, which didn't help my blood pressure when she took it. It was up to 147/67.

She said "Where are your prescription meds, you were asked to have them all ready in a bag?" I said "This is it, some eye drops and a nose spray." She also took note of the vitamins that I take, and my auger juicer.

She asked a lot about my and my family's medical histories, took a little bit of blood from my finger which gave her a cholesterol reading, listened to my heart and chest, and pronounced me live and well.

Then, Pete called to say that my van was ready. Ray took me there to pick it up, and I swear Pete didn't fix it, he took the radiator cap off, and drove a new van under it!! LOL! It runs like a top now, and even the AC is colder.

On the way home, I stopped at BestBuy to see if they could do anything with my digital camera. A little green light stays on, even when it's turned off. That was running down the battery, so I had to keep the battery unplugged to stop it. The camera man said that the life span of digital cameras isn't that great, (I have had it for 4 years), and I realized that it would probably cost more to fix it than it was worth, so I bought a new camera. Nothing too fancy or expensive, but it still has more buttons for me to get used to.

So my three mechanical problems are all solved. My computer, van and camera are all running great today.

2 comments:

Glad you got your "new" van running well.

Thank you, DD.

My life is so much better with a good running van, computer and camera!

I hope nothing else breaks down.

Happy Tails and Trails, Penny.

Post a Comment